Best Tax Consultant in Nepal

Tax Consultant in Nepal provides the most reliable Corporate, Tax and Business Services in Nepal. We provide services to Small Business, Medium Enterprises as well as Startups. We are involved in growing and scaling your Business. Give us a call to get a Free Consultation Today!

Corporate Lawyers

Chartered Accountants

Chartered Financial Analysts

About Us

Tax Consultant Nepal provides the most reliable Corporate, Tax and Business Services in Nepal. We provide services to Small Business, Medium Enterprises as well as Startups. We are involved in growing and scaling your Business. Give us a call to get a Free Consultation Today's.

Tax Consultant in Nepal provides the most reliable Corporate, Tax and Business Services in Nepal. We provide services to Small Business, Medium Enterprises as well as Startups. We are involved in growing and scaling your Business. Give us a call to get a Free Consultation Today!

Reliable Financial Consulting Services in Nepal

Hello there are you searching for a tax consultant in Nepal that is reliable and helps you manage personal finances, Sometimes managing taxes and audit can be hard for new business owners as there are plenty of complex processes involved. If you’re one of them you are at the right place as you’ll receive guidance from experts that helps your company run smoothly without the fear of audits and taxes. Today we’ll explain how working with certified professionals can help you manage finances and pay taxes from time to time, also we will discuss the roles and responsibilities of tax and audit consultants in Nepal.

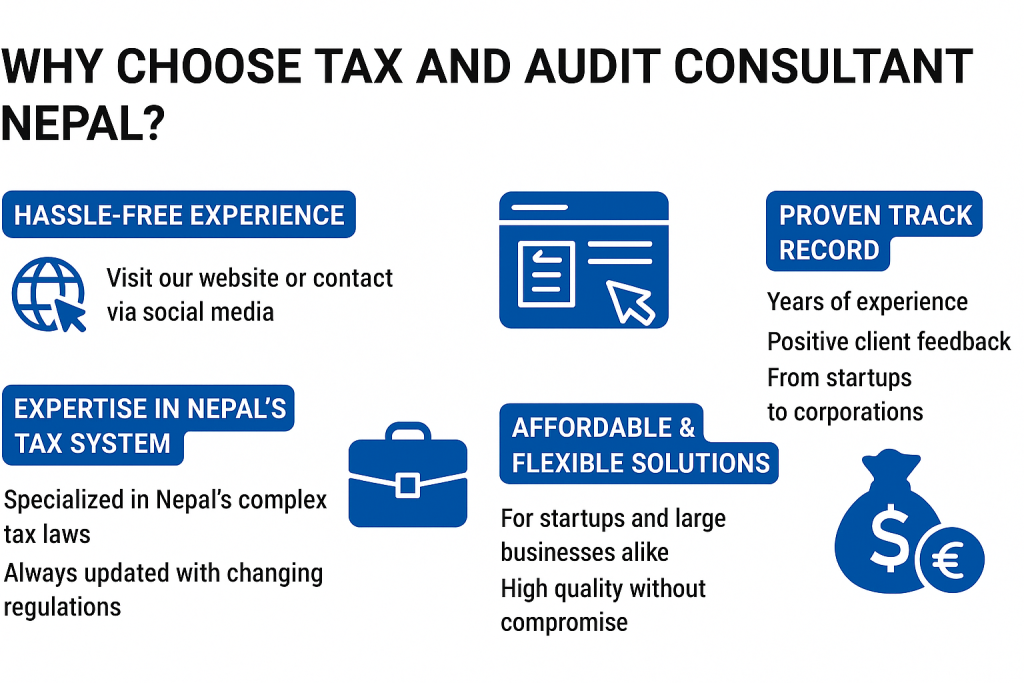

We here at tax and audit consultation nepal are different from the other consultants as we provide transparent, honest and high quality services which are easy to access and more affordable than other places. We discuss all the details with our client and our main motive is the satisfaction of customers.

Tax Consultant Services in Nepal

Book-Keeping, Accounting and Taxation Services you can trust

Tax Planning

Tax planning involves strategically organizing finances to minimize tax liability legally. It includes analyzing income, expenses, and investments to take advantage of deductions, credits, and exemptions.

Financial Recording

Financial recording is the systematic process of documenting all financial transactions of a business or individual. It involves maintaining accurate records of income, expenses, assets, and liabilities.

Payroll Processing

Payroll processing involves calculating and distributing employee wages, including deductions for taxes and benefits. It ensures timely and accurate payment of salaries, manages tax withholdings, and maintains compliance with labor laws.

Financial Analysis

Financial analysis involves examining financial data to assess a company's performance, stability, and profitability. It includes reviewing financial statements, calculating ratios, and interpreting trends.

Audit Services

Audit services involve independent examination and verification of financial records and business practices. Auditors assess the accuracy of financial statements, evaluate internal controls, and ensure compliance with regulations.

Financial Planning

Financial planning is the process of setting and achieving financial goals through careful management of resources. It involves assessing current financial status, identifying objectives, and developing strategies for savings, investments, and risk management.

Most Highlighted Consultant:

Business Pan Registration in Nepal

Planning to open up a business in Nepal? One of the initial and most important steps is to get your Business PAN. You might have heard the term, but what is it really and why is it such a big deal? It’s like your business ID card — without it, you can’t officially run your business the legal way. From making tax payments to opening a business banking account, a PAN number brings it all in order.

Company Registration in Nepal

You have a great business idea. You want to start a company for that, but how? Starting a business can be an exciting yet scary and tough journey, and registering your company is the first step to bring your ideas to life. In this article, you will learn all about registering a company in Nepal with our help – Company Register Nepal.

Import Tax Procedure in Nepal

Love something you see online but it is not available in Nepal?You’d probably want to import it, right? So, how do you import things in Nepal? We will discuss all about it in this article.First of all, you need to know that import process is governed by the Department of Customs and monitored by the Inland Revenue Department (IRD).

Inventory Management Planning Systems in Nepal: A Beginners' Guide

Having a business in Nepal—whether it is a small shop in Kathmandu .or a factory in Hetauda—means managing your inventory. Having too much stock can tie up your cash while having too little can lose you customers

Management Consulting in Nepal: A Simple Guide

Conducting business in Nepal is like a rollercoaster ride–you never know what the constantly changing market throws at you. With the markets changing fast and competition heating up, making the right choices is hard. That’s where management consulting comes into the picture.

Market and Business Research Companies in Nepal: All You Need To Know

You should visit us at least once a year especially during the tax season but once we’ve taken you as a client we will be eager to help you anytime you waStarting or growing a business in Nepal can feel like climbing a steep hill, especially with so much competition and constant change. Whether you’re running a cafe in Thamel or a tech startup in Biratnagar, understanding your customers and market is the key. nt anytype of help or support in that matter.

Preparing Financial Statement for Year-End Audit in Nepal

With the fiscal year end coming near, one of the most important activities of any business is the financial statement preparation for the year-end audit (Annual Audit). It also serves to obtain a clear picture of your company’s financial situation, win stakeholders’ trust and avoid penalties.

VAT Registration in Nepal: Made Easy

VAT (Value Added Tax) is a type of tax that businesses collect from customers when selling goods or services. Instead of taxing the entire cost of the item, VAT is only applied to the value added at each stage of production or sale.

Steps to File VAT in Nepal: A Simple Guide

VAT. Ring a bell? Of course it does. VAT, or Value Added Tax is amongst the most significant elements of Nepal’s tax system. Probably also the most commonly known tax in Nepal.

Tax Dispute and Appeal Process in Nepal

Imagine this: You file and pay the tax amount you thought you were supposed to and relax. Later, you open your mailbox (or let’s be real–your email) and see a notice from IRD saying you still have amount due to be paid.

Understanding ETDS Filing in Nepal: A Simple Guide

Filing taxes can feel overwhelming, but Nepal’s Electronic Tax Deduction at Source (ETDS) system makes it much easier for businesses and organizations to stay on top of their tax responsibilities.

Understanding the External Audit Process in Nepal

Are you familiar with external audits? Well, if you own a business, you should be.From this article, you can understand how it works and why it is required.

A detailed guide of the process of tax audit in Nepal.

If you’re running a business in Nepal then you must be well aware of the term tax audits. But what exactly is tax audit and what are its importance for running a business. More importantly, what is the process of tax audit in Nepal and how can GFCS Nepal benefit you in that process? Don’t worry we’ve got you covered. In this article we’re going to discuss just that and we’ll break it down in a simple and easy to understand way so that you understand all the aspects clearly.

A detailed guide on Person PAN Registration in Nepal.

If you’re an earning professional in Nepal then you must be somewhat aware about the concept of personal Permanent account number(PAN). But what is a person PAN specifically is what we will look into today.

Business Consulting Companies in Nepal- How GFCS Nepal Helps You Grow Smarter

Running a business comes with a package of difficulties and challenges but also provides opportunities in return. Whether you’re planning on starting a business of any scale may it be a small business or a large scale industry it is necessary to understand that you can’t do it all alone and this is exactly where business consulting companies come in.

Business Expenses deduction in Nepal: A complete guide for entrepreneurs

Running a business can sometimes be very chaotic as it does come with its fair share of expenses. But do you know many of these expenses are quite unnecessary and can be reduced? These are those expenses that are being added up due to lack of proper knowledge and guidance. Understanding the concept of business expense deduction can help you save money and manage your finances smoothly. Today we will help you understand everything about expense deduction and help you navigate the tax system of Nepal.

Business Plan in Nepal- A simple guide by GFCS Nepal

Starting a business is very exciting, but it can get very scary and difficult. A business with only a name and idea cannot prosper. You will need a proper plan specified as a business plan.At GFCS Nepal, we help entrepreneurs and startups like you create smart plans to run your business smoothly.

Detailed Guide for the process of filing excise duty in Nepal.

If you are somehow related to business or trade you must be aware of the term excise duty. It’s another form of tax that is only charged on the import of certain products. But many people do not know how to actually file for excise duty in Nepal. But, worry not because you’re in the right place today. We’ll guide you through the process and break it down so you can understand the process of filing for excise duty easily.

Digital Service Tax- A Simple Guide by GFCS Nepal

All of us have seen digital services like google ads, facebook promotions or subscription of netflix or amazon prime. But have you ever wondered if these services even have to pay for taxes in Nepal? Well the answer to the question is yes any form of service provided in exchange of money must pay taxes and these services pay taxes which is termed as Digital Service Tax(DST).

Filing tax on rental income in Nepal: A complete guide

Are you associated with earning rental income in nepal? If that’s the case then you might be curious on how to file taxes for your rental earnings. Don’t worry at GFCS Nepal we make your process of rental tax filing as reliable and simple as possible.

Labor Audit in Nepal - What every business needs to know

While running a business you might be very cautious of paying taxes, managing payrolls and record keeping but while focusing on these aspects some necessary processes might get un-noticed and labor compliance is one area that is mostly overlooked. And that’s where a labor audit comes in.

Tax and VAT Support Company in Nepal: Here’s What You Need to Know-By GFCS Nepal

Opening a business is taken as the fulfillment of wishes but managing Tax and VAT can be quite overwhelming. Whether you own a small business or an established firm, tax and VAT is something you just can’t ignore

Management Audit in Nepal - A Practical Guide

Are you worried because your business is not functioning as smoothly as it should? It feels you’re lacking something or whether the business is not efficient. Are you failing to meet your goals or are not being able to manage your team effectively or use your resources wisely? If this is what you’re going through then it might be the time to consider doing a management audit.

Payroll Management in Nepal- Everything You Need to Know

If you run a business you might already know the fact that the employees are like a builder that helps to build your business from zero and how important they are to your success. But managing teams, products and customers are on one hand but there’s another task namely payroll management that is often confusing.

Prepare tax audit in nepal:A complete guide

Tax audit is often taken as a difficult and complicated task, the word itself can make many business owners feel uneasy considering the complexities. But don’t worry as with a bit of guidance and preparation it can be completed hassle free. In fact it is a great opportunity to maintain accountability and improve your financial condition.

Startup business planning in Nepal: A friendly guide by GFCS Nepal

If you’ve got a great idea on starting a new business but are actually confused on what to do and what not to do and also feel the task of setting up a business complicated then you’ve arrived at the right spot at GFCS Nepal we’ve got you covered up.

Tax Planning in Nepal: A Simple Guide by GFCS Nepal

As we all know, taxes are a part of life whether for an individual or business. But, just paying taxes is not enough in order to save money legally. If you want to avoid unnecessary penalties, make the most of the income you’re earning you need a powerful strategy namely tax planning.

Tax return filing in Nepal: A simple guide by GFCS Nepal

If you are associated with any type of earning activities either you are employed or own a business the process of taxation must be quite complicated for you and if you’ve ever wondered on how to file for tax return in Nepal then you are not the only one complicating this process. Many starters are not even familiar with this process.

VAT registration in Nepal: step by step guide by GFCS Nepal

If you are a business owner or someone who is planning to open a business and are planning to grow your business to unprecedented scale then you might be familiar or at least heard of the term Value Added Tax (VAT) registration and you might be confused if you actually need it or how important it is to register for VAT.

What is a Due Diligence Audit? A simple guide by GFCS Nepal

If you are very enthusiastic about starting a new business and have done research as to what are the major steps that must be followed while opening a new business. If yes, there’s one important step you must never skip and that is Due Diligence Audit(DDA).

Register a New Business in Nepal

Tax Consultant in Nepal provides a Three-Step Workflow to our Clients from preliminary consultation, choosing of the rightful package, and obtaining our Services.

Consultations

Get a Free Initial Consultation to share your requirements.

Choose Package

Choose the Package that fits right for you.

Get Your Services

Obtain Quick, Efficient & Effective Service Delivery through Professionals.

Frequently Asked Questions (FAQs):

Why do I need a tax and audit and tax consultant?

A tax and audit consultant is necessary for your business as they help you to go through the complex tax structure of Nepal without any difficulties. With their expertise you can worry less about the legal procedures and focus on growing your business.

What services do tax and audit consultants provide?

Tax and audit consultants provide you the facilities like tax planning, tax filing, audit services and financial consultations and also provide necessary steps to minimize fraud and run your business smoothly.

Do I need a consultant if I run a small business?

Yes, even if you own a small business it is quite necessary for you to hire a consultant as you can smoothly focus on your business rather than on the legal side of things so actually it might be more necessary for you to hire a consultant if you are starting a startup or a small scale business.

How can I get started with you?

Once you decide you want a consultant you can contact us through the given contact info or even reach us through the social media and as soon as we receive your request we will set up a meeting and discuss all the procedures required for hiring a consultant.

Can you help me save money on taxes?

Yes, our team will work on finding strategies on saving taxes and make your work very efficient. You will not have to pay more than necessary with our support behind you.

How often should I visit a consultant for smooth operation?

You should visit us at least once a year especially during the tax season but once we’ve taken you as a client we will be eager to help you anytime you want anytype of help or support in that matter.

Do you offer services for individuals as well?

Yes, we do help individuals by helping them manage their finances, with their taxes and audits .

Contact us

E-Mail: info@gfcsnepal.com

Telephone: +977 984-9417661

Address: Banasthali Chowk, Kathmandu